Tell us about a time that you delighted a customer.

Why would you be an ideal candidate for this position?

Tell us about a time that you delighted a customer.

How many years of sales experience do you have?

937 Payroll automatically screens every candidate for work opportunity tax credit eligibility, which can save your business up to $9,600 in tax credits per new hire. 937 Payroll can also manage all of the paperwork to help you file your tax credit.

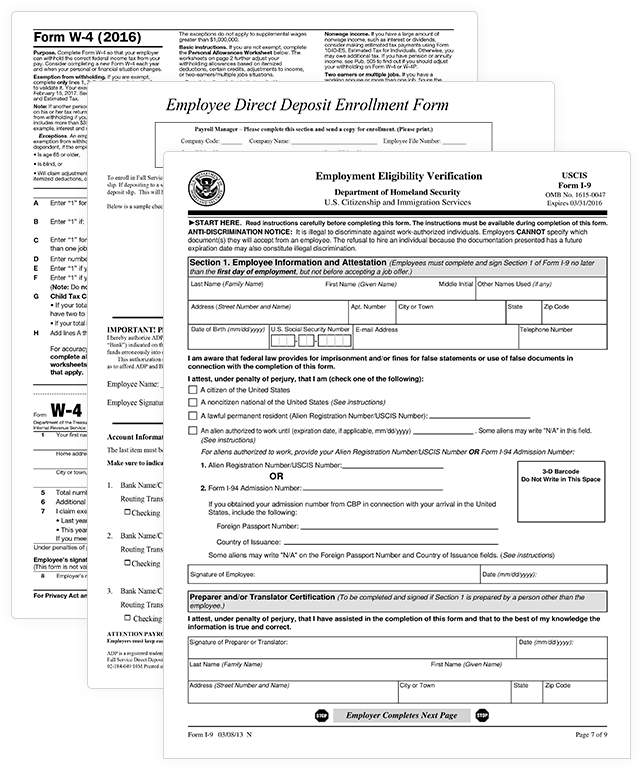

New hires can complete their I-9, W-4, employee handbook, bank details, and any custom onboarding documents you might have through the 937 Payroll electronic onboarding platform.

937 Payroll is fully integrated with the USCIS E-Verify program and allows you to ensure a legal workforce. You can also order background checks through our integrated background check provider.

937 Payroll

937 Payroll |

|

|---|---|

| Post to multiple job boards & social media sites in one click | Yes |

| Electronic onboarding | Yes |

| Custom onboarding documents | Yes |

| Searchable resume database | Yes |

| Pre-screen candidates with video & audio | Yes |

| One-click apply with LinkedIn, Monster and Facebook | Yes |

| Automatically schedule interviews with candidates | Yes |

| Display work opportunity credit values in applicant tracking system | Yes |

| Automatically identify candidates who live in Rural Communities ($2,400 tax credit per employee) |

Yes |

| Automatic alerts when employees meet threshold requirements and qualify for tax credits | Yes |

| Video Conferencing | Yes |

| Customizable and hosted careers page | Yes |

| E-signature of Form 8850 | Yes |

| E-signature of Form 9061 | Yes |

| Automatically create tax packet to file Form 5884 to claim credit | Yes |